Enhabit Reports Second Quarter 2023 Financial Results

Revises Full-Year Guidance

Announces Intent to Launch Strategic Alternatives Process Subject to Satisfaction of Conditions in Tax Matters Agreement

Company to host a conference call tomorrow, August 10, 2023 at 10 AM EDT

DALLAS, TX – August 9, 2023 – Enhabit, Inc. (NYSE: EHAB), a leading home health and hospice care provider, today reported its results of operations for the second quarter ended June 30, 2023.

“During the second quarter, we negotiated ten new contracts with Medicare Advantage payors, increased our clinical staff with 203 net new full-time nursing hires, and continued to outperform the industry average with a 30-day hospital readmission rate that is 370 basis points better than the national average,” said Enhabit’s President and Chief Executive Officer, Barb Jacobsmeyer. “While we continue to make progress with our strategic initiatives, the pace of the progress has not been fast enough in 2023 to meet our initial guidance. We remain confident our teams’ relentless efforts to retain staff, manage costs, and deliver high-quality care will enhance our value long term.”

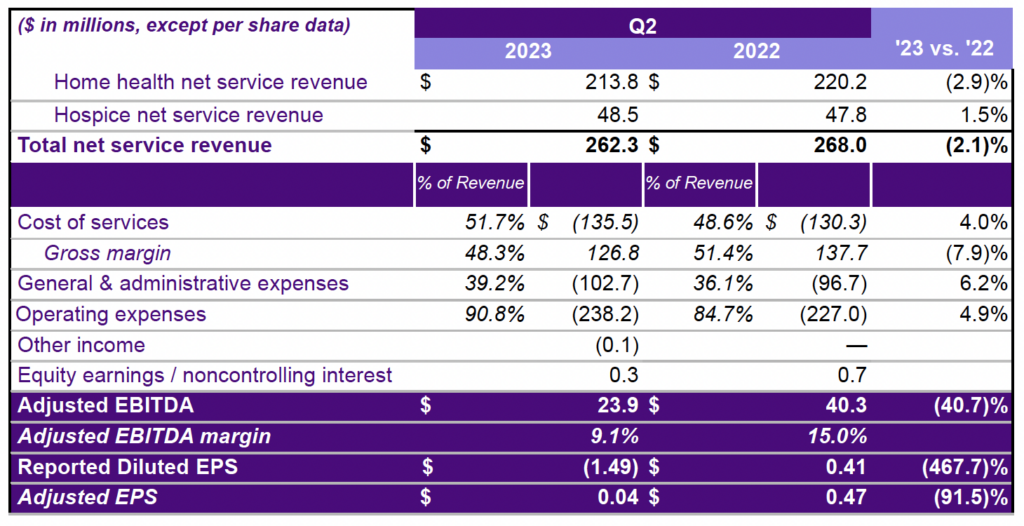

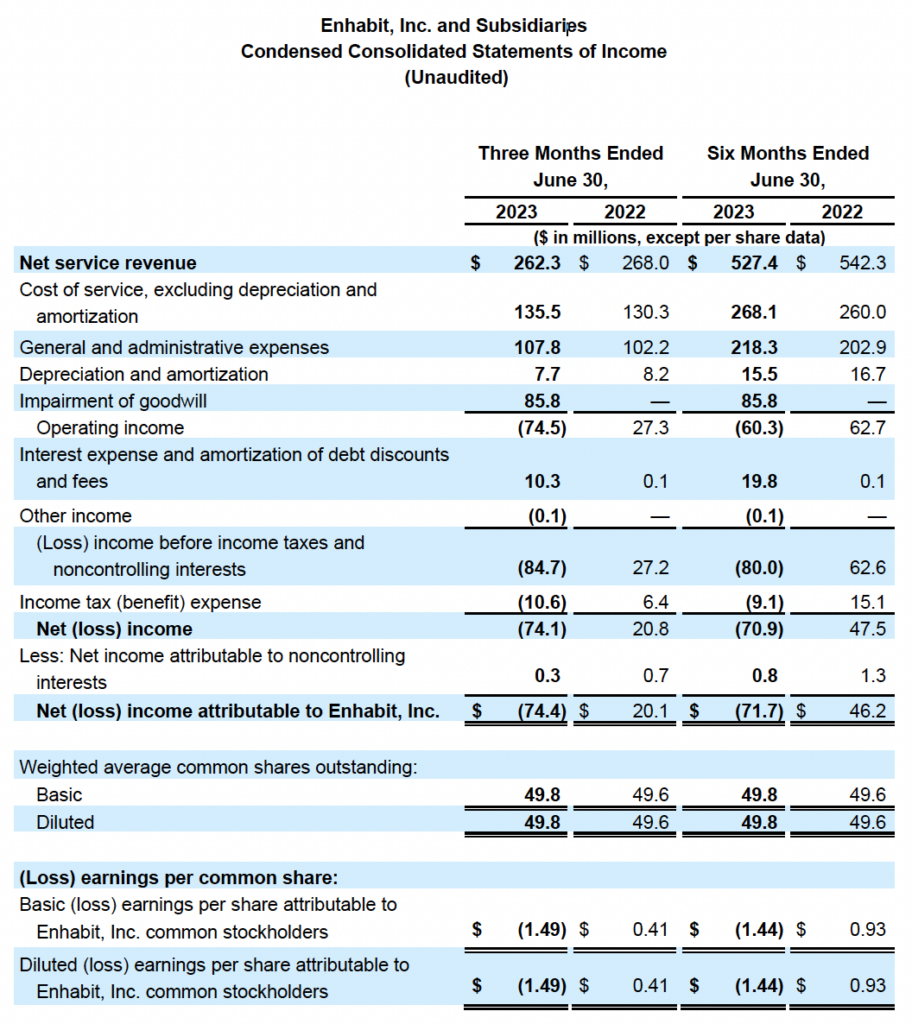

QUARTERLY PERFORMANCE – CONSOLIDATED

- Net service revenue of $262.3 million

- Net loss of $74.1 million

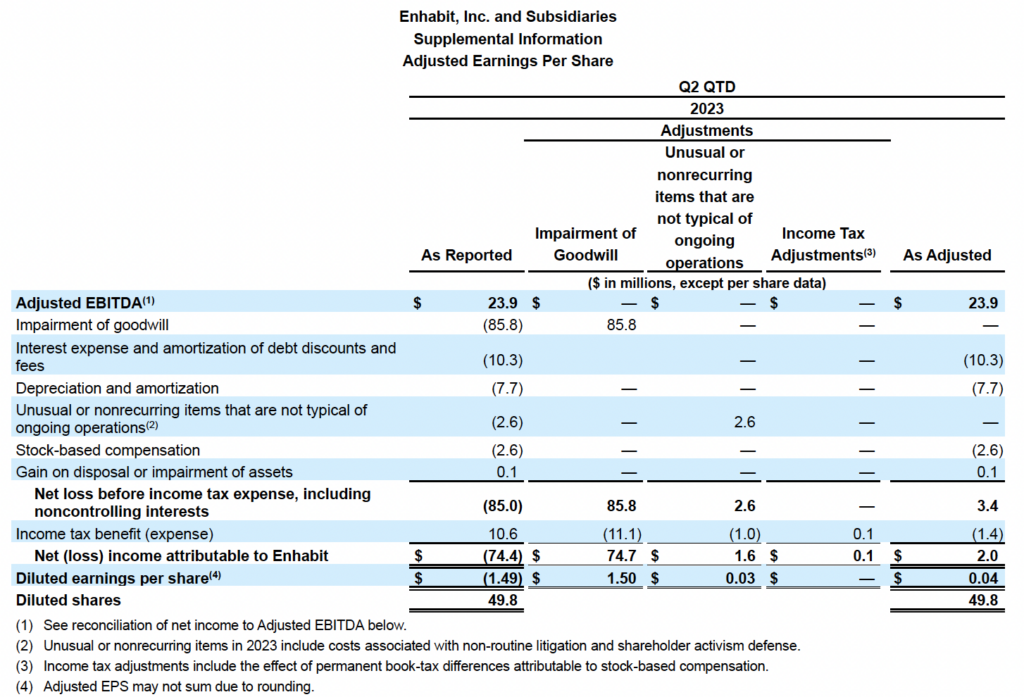

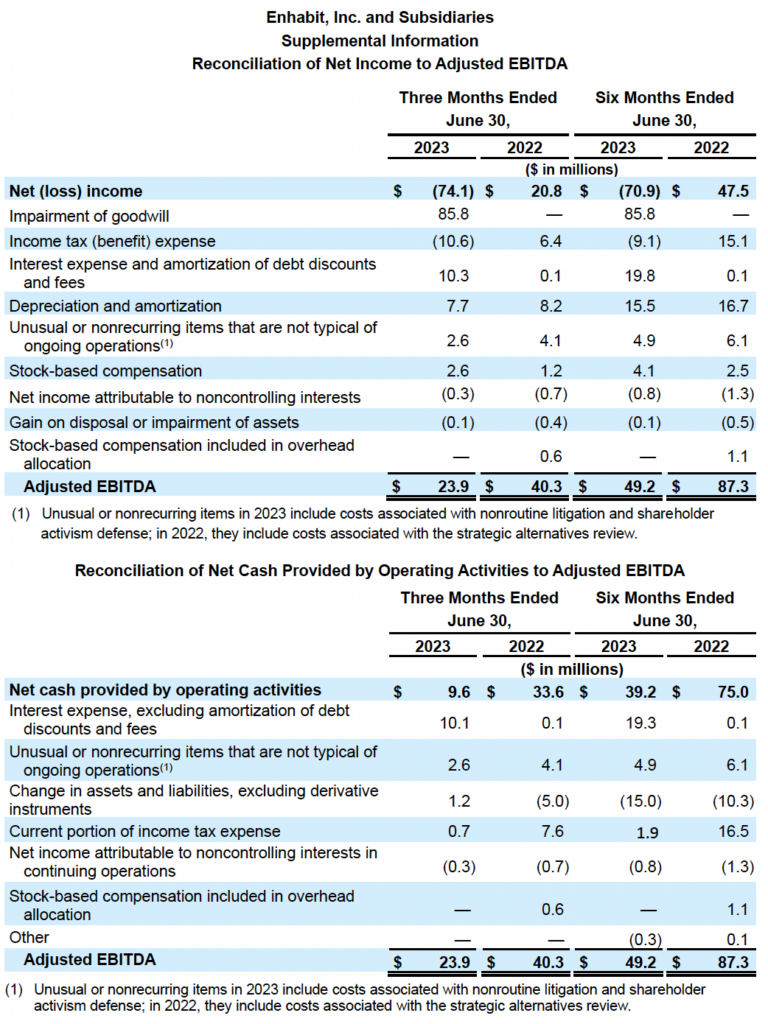

- Adjusted EBITDA of $23.9 million

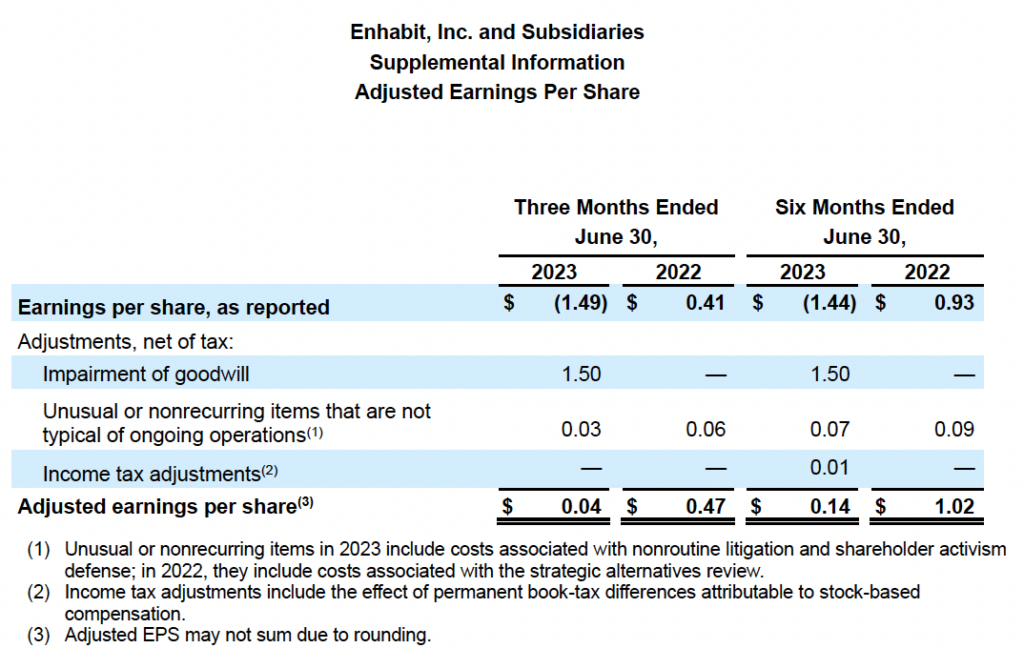

- Loss per diluted share of $1.49

- Adjusted earnings per share of $0.04

RECENT COMPANY HIGHLIGHTS

- Negotiated ten new Medicare Advantage payor contracts in the second quarter

- Shifted approximately 5% of previous non-episodic visits into non-episodic payor innovation contracts at improved per visit rates

- Continued strong growth in home health Medicare Advantage admissions with non-episodic admissions up 38.0% driving total admission growth of 3.2% year over year

- Continued recruiting success adding 203 net new full-time nursing hires in the second quarter

- Opened two de novo home health locations in Montana in April and one hospice de novo location in Texas in May

- Hospice cost per day stabilized sequentially

- 30-day hospitalization readmission rate is 370 basis points better than the national average

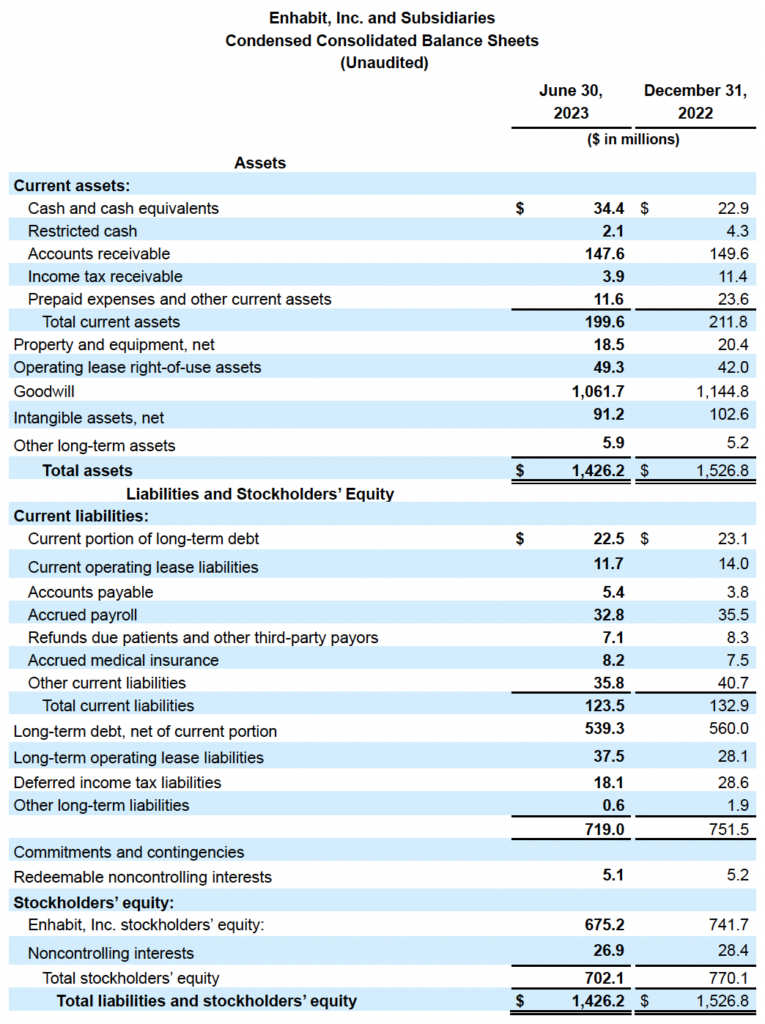

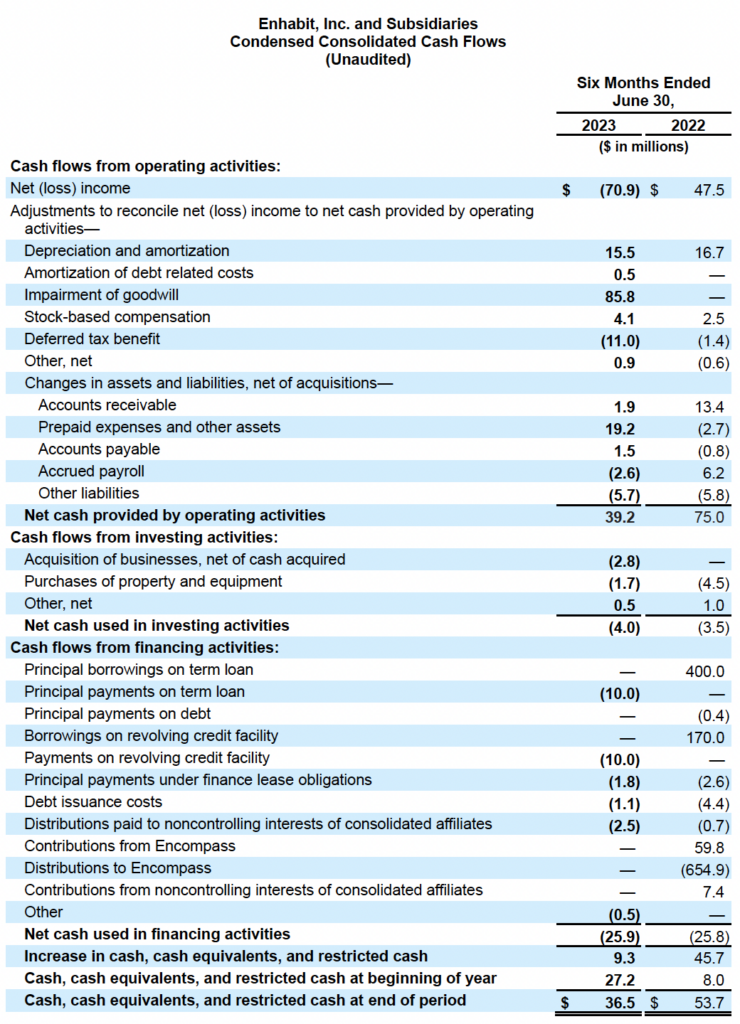

FINANCIAL RESULTS

Consolidated

The continued shift to more non-episodic admissions in home health and the resumption of sequestration reduced consolidated net service revenue and Adjusted EBITDA $10.5 million year over year.

Adjusted EBITDA decreased year over year primarily due to the continued shift to more non-episodic admissions in home health, incremental costs associated with being a stand-alone company, and the resumption of sequestration.

SEGMENT RESULTS

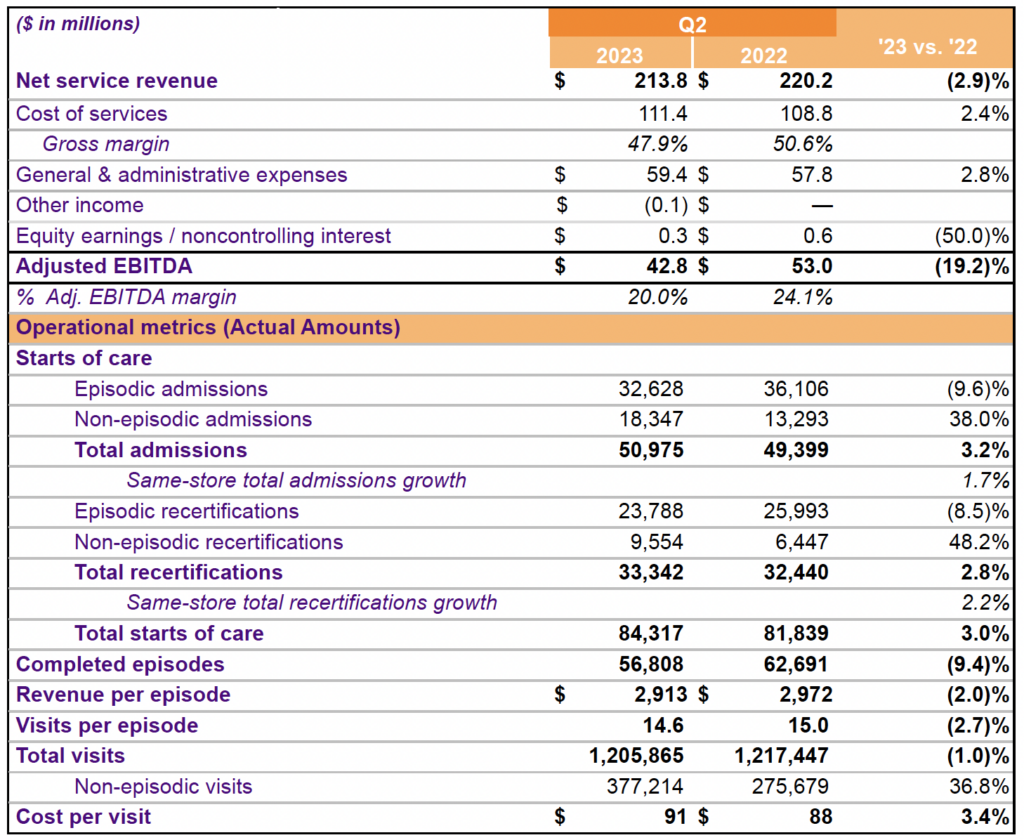

Home health

The year-over-year decrease in revenue was due primarily to the continued payor mix shift to more non-episodic admissions and the resumption of sequestration. Revenue per episode decreased year over year primarily due to the resumption of sequestration and patient mix.

Adjusted EBITDA decreased year over year primarily due to the continued payor mix shift to more non-episodic admissions, the resumption of sequestration, and increased general and administrative expenses associated with new stores. Cost per visit increased year-over-year primarily due to increased contract labor, merit and market rate increases for clinical staff, and increased costs associated with employee group medical claims partially offset by improved clinical productivity.

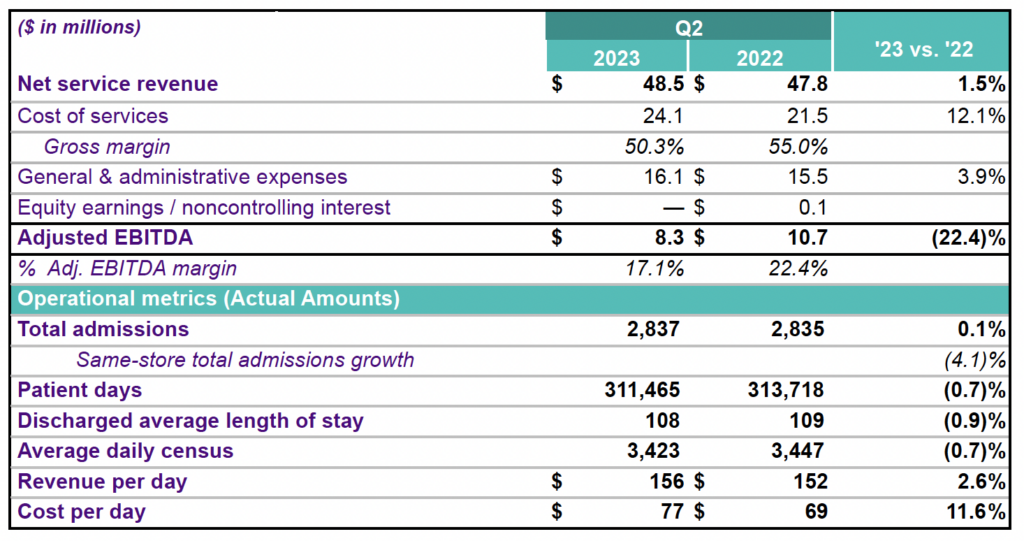

Hospice

Net service revenue increased year over year primarily due to increased Medicare reimbursement rates.

Adjusted EBITDA decreased year over year primarily due to higher cost of services resulting from increased labor costs. Cost per day increased year over year primarily due to increased labor costs resulting from the implementation of the new case management model, including costs associated with dedicated on-call and triage nurses.

TAX MATTERS AGREEMENT

Enhabit also announced today that it is undertaking steps to attempt to satisfy the conditions in its Tax Matters Agreement (“TMA”), dated June 30, 2022, with Encompass Health Corporation relating to certain transactions involving the Company. The conditions in the TMA include securing a tax opinion of legal counsel, satisfactory to Encompass Health in its sole and absolute discretion, that the actions taken by Enhabit would not jeopardize the tax-free treatment of the spin-off of Enhabit.

Upon satisfaction of these conditions, the Enhabit board, with the assistance of independent advisors, intends to launch a strategic alternatives process. As part of any such process, the board expects it would consider a wide range of options for the company including, among other things, a potential sale, merger or other strategic transaction. There can be no assurance that the conditions in the TMA will be satisfied, that Enhabit will initiate such a process, or if launched, that a process would result in Enhabit pursuing a particular transaction or other strategic outcome.

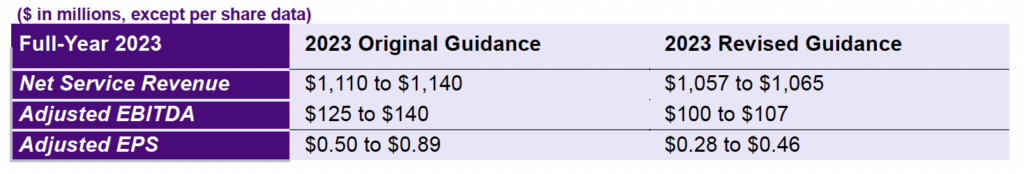

GUIDANCE

The Company revised its full-year 2023 guidance as follows:

For additional considerations regarding the Company’s 2023 guidance ranges, see the supplemental information posted on the Company’s website at http://investors.ehab.com.

CONFERENCE CALL INFORMATION

The Company will host an investor conference call at 10 AM Eastern Time on August 10, 2023 to discuss its results for the second quarter of 2023. To access the live call by phone, dial toll-free (888) 660-6150 or international (929) 203-0843; the conference ID is 5248158. A simultaneous webcast of the call, along with supplemental information, may be accessed by visiting https://events.q4inc.com/attendee/923162031. Following the call, a replay will be available at Enhabit’s investor website.

ABOUT ENHABIT HOME HEALTH & HOSPICE

Enhabit Home Health & Hospice (Enhabit, Inc.) is a leading national home health and hospice provider working to expand what’s possible for patient care in the home. Enhabit’s team of clinicians supports patients and their families where they are most comfortable, with a nationwide footprint spanning 255 home health locations and 108 hospice locations across 34 states. Enhabit leverages advanced technology and compassionate teams to deliver extraordinary patient care. For more information, visit ehab.com.

OTHER INFORMATION

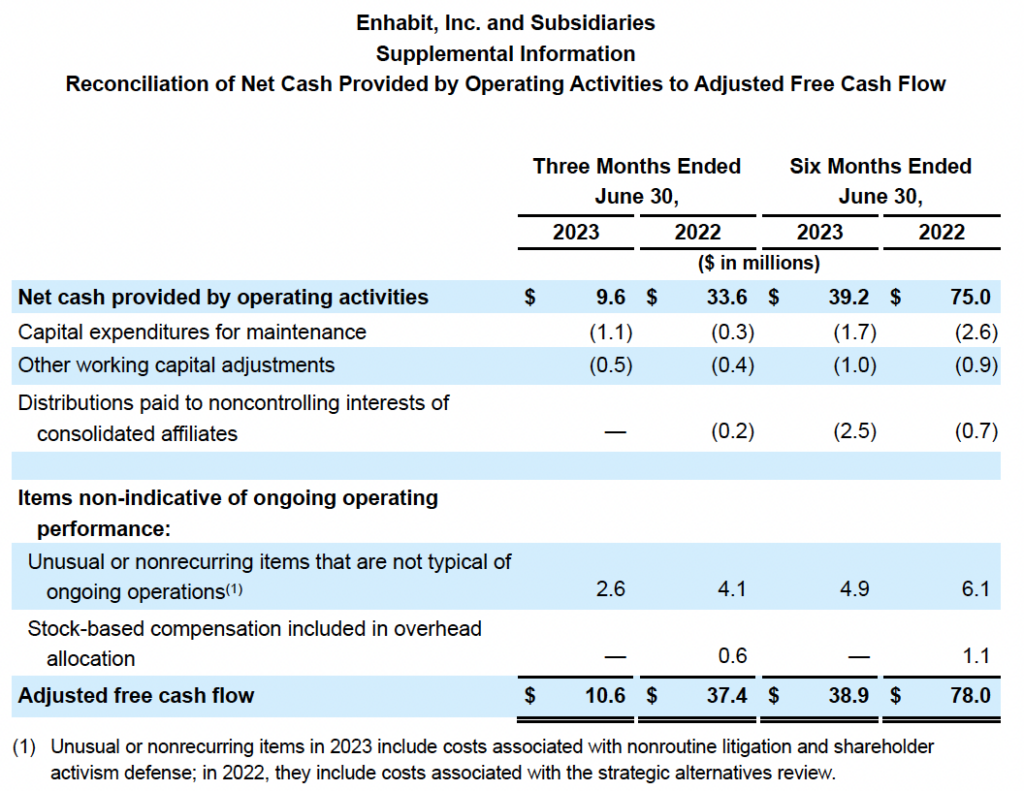

Note regarding presentation of non-GAAP financial measures

The financial data contained in this press release and supplemental information includes non-GAAP (generally accepted accounting principles (GAAP)) financial measures as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, Adjusted EBITDA margin, leverage ratios, adjusted EPS, and adjusted free cash flow. See “Reconciliations of Non-GAAP Financial Measures” for reconciliations of the non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP.

The Company is unable to reconcile the guidance for Adjusted EBITDA and adjusted EPS to their corresponding GAAP measures without unreasonable effort due to the inherent difficulty in predicting, with reasonable certainty, the future impact of items that are outside the control of the Company or otherwise non-indicative of its ongoing operating performance. Accordingly, the Company relies on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K. Such items include, but are not limited to, gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims);

and items related to corporate and facility restructurings. For the same reasons, the Company is unable to address the probable significance of the unavailable information.

Note regarding reconciliations of non-GAAP financial measures

This press release contains the reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP. Such non-GAAP financial measures exclude significant components in understanding and assessing financial performance and should therefore not be considered superior to, as a substitute for or alternative to the GAAP financial measures presented in this press release. The non-GAAP financial measures in the press release may differ from similar measures used by other companies.

Note regarding presentation of same-store comparisons

The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on home health and hospice locations open throughout both the full current period and the immediately prior period presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company’s results of operations.

FORWARD-LOOKING STATEMENTS

Statements contained in this press release which are not historical facts, such as those relating to future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All such estimates, projections, and forward-looking information speak only as of the date hereof, and Enhabit undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by Enhabit include, but are not limited to, our ability to execute on our strategic plans, regulatory and other developments impacting the markets for our services, changes in reimbursement rates, general economic conditions, our ability to attract and retain key management personnel and healthcare professionals, potential disruptions or breaches of our or our vendors’ information systems, the outcome of litigation, our ability to successfully complete and integrate de novo developments, acquisitions, investments, and joint ventures, and our ability to control costs, particularly labor and employee benefit costs. In addition, with respect to the Tax Matters Agreement (TMA) and the potential launch of a strategic alternative process, these factors include, our ability to receive Encompass Health Corporation’s approval to pursue a strategic transaction as required under the TMA and our ability to successfully pursue and complete a strategic transaction, as discussed above. Our Form 10-K and subsequent quarterly reports on Form 10-Q, each of which can be found on the Company’s website at http://investors.ehab.com and the SEC’s website at www.sec.gov, discuss other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this press release. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this press release.

Investor Relations Contact

Jordan Loyd [email protected] 469-860-6061

Media Contact

Erin Volbeda [email protected] 972-338-5141