Urges Stockholders to Vote FOR Enhabit’s Director Nominees on the YELLOW Proxy Card

DALLAS–(BUSINESS WIRE)–Enhabit, Inc. (NYSE: EHAB) (“Enhabit” or the “Company”), a leading home health and hospice provider, today sent a letter to stockholders in connection with its upcoming 2024 Annual Meeting of Stockholders scheduled for July 25, 2024. Stockholders of record, as of the close of business on June 5, 2024, are entitled to vote at the 2024 Annual Meeting.

The full text of the letter follows and can be found at investors.ehab.com/2024-annual-meeting/, along with Enhabit’s definitive proxy materials and other materials regarding the Board of Directors’ recommendations for the 2024 Annual Meeting.

Protect the Value of Your Investment

Vote the Enclosed YELLOW Proxy Card “FOR” Enhabit’s Highly Qualified Director Nominees

Dear Fellow Stockholders,

At Enhabit’s 2024 Annual Meeting, AREX Capital Management, LP is attempting to take control of Enhabit’s Board of Directors (the “Board”) by replacing nearly all Enhabit’s independent directors with their own nominees.

Enhabit’s Board was intentionally designed to have the right mix of expertise to understand the key drivers of the business, as well as the functions that are necessary to oversee the management of a stand-alone, public company.

- Enhabit’s director nominees possess deep experience with the three key drivers of our business: payors, hospital networks and labor management. No candidate on AREX’s slate has the same level of insight into any of these drivers.

- AREX’s slate has negligible public company experience in either director or non-interim senior management roles, whereas Enhabit’s nominees have public company board experience as well as current and extensive experience in public company C-suites. Our candidates also include directors with current experience in public company financial controls and auditing procedures, executive compensation, IT and cybersecurity. AREX’s candidates have negligible or stale experience in these areas.

- AREX’s insistence that effective board oversight requires multiple directors with direct home health and hospice experience is contradicted by industry practices. Boards of the companies that AREX has asserted as our “peers” are comprised of directors who have a diverse range of senior-level skills and experiences adjacent to home health and hospice, in line with the approach of the Enhabit Board.1 At each of these companies, it appears that only one independent director has direct operating experience within the home health and hospice industry. Even putting aside the quality of the experience of AREX’s nominees, AREX’s assertion that it is necessary to install six directors with home health and hospice experience for the Board to properly exercise its oversight function is simply incorrect.

- In the attempt to portray their candidates as having direct home health and hospice experience, AREX improperly equates experience in companies that provide any kind of care in the home — for example, community care and senior living facilities — with experience in home health. In fact, home health and hospice operates in a different environment from the regulatory, reimbursement and referral process perspectives than these other businesses.

- In constructing such a narrowly focused slate, AREX has selected candidates who are demonstrably inferior to the Company’s nominees in terms of relevant industry experience, public company board experience, complementary skill sets and career accomplishments.

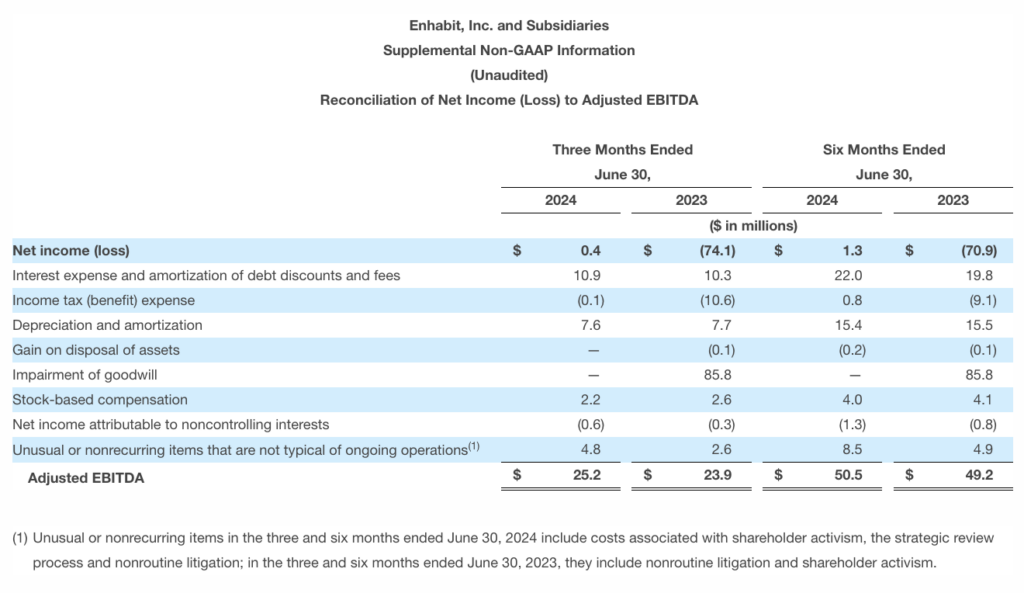

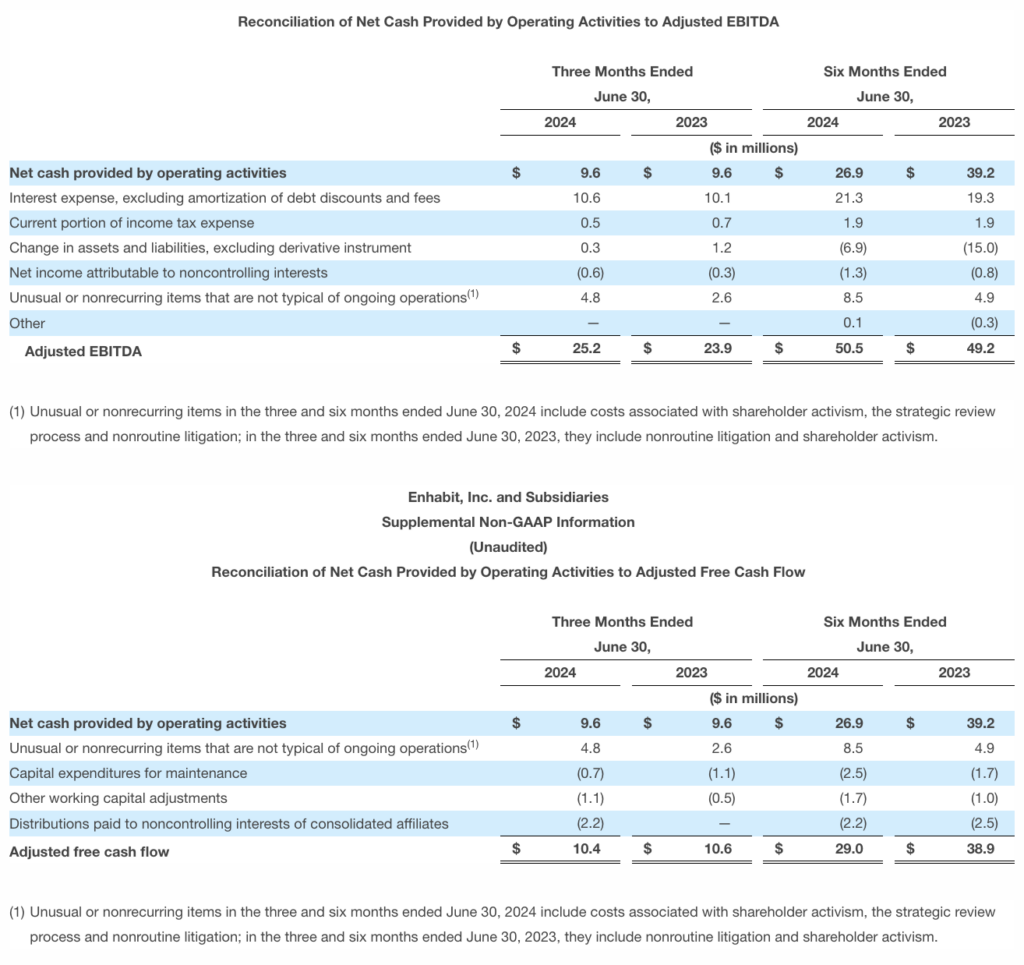

Enhabit’s Board is almost wholly refreshed since its separation from Encompass Health Corporation (“Encompass”) two years ago. Each of the Company’s directors is engaged and focused on enhancing value for all stockholders. Our performance over the last two quarters indicates that the business has stabilized and is positioned for profitable growth. There is more work to do – and Enhabit’s nominees are the right nominees to oversee the continued execution of the Company’s strategy.

In addition, AREX intends to form a “Transformation Committee”. AREX claims that this committee would not be a “shadow management team” and would instead operate like committees with a similar name that have been used at other public companies. However, unlike at other companies, AREX plans for this committee to be comprised of four directors who have no public company oversight experience and lack material senior operating experience. In fact, their career experience is commensurate with positions that would report to members of Enhabit’s C-suite. Certain of the initiatives contained in AREX’s “plan”, such as restructuring of the sales organization, are initiatives that are typically carried out at the executive level. Given the nature of the experience of the individuals and the initiatives in AREX’s “plan”, we don’t believe this committee would operate as anything short of a shadow management team, likely with some degree of executive authority. Our CEO has serious concerns about continuing to serve under this “Transformation Committee” as proposed by AREX.

AREX CONTINUES TO DEMONSTRATE ITS LACK OF UNDERSTANDING OF THE BUSINESS AND INDUSTRY

While AREX claims its candidates have more than 40 years of home health experience, AREX’s public statements, as well as the lack of substance in their proposed “plan”, demonstrate that AREX does not understand Enhabit’s business dynamics. For example:

AREX claims that Enhabit’s inability to manage the ongoing payor mix shift is directly responsible for the Medicare fee-for-service market share loss.

- The implication that growth in Medicare Advantage and improvement in the payment rate for Medicare Advantage admissions results in a reduction in Medicare fee-for-service market share is simply wrong. To the contrary, the payor innovation program establishes Enhabit as a high-quality provider that can accept a wide range of referrals for diverse payors, which is necessary in this changing environment. Over the past two years, referral sources have increasingly demanded that providers, including Enhabit, serve both the Medicare Advantage and Medicare fee-for-service business. Refusing to provide care to Medicare Advantage patients would result in a decline in Medicare fee-for-service referrals.

- Navigating this dynamic is fundamental in the current referral environment. Shortly after the separation from Encompass, Enhabit’s management team implemented a system that enables frontline sales and branch-level personnel to discern whether individual referral sources provide a favorable mix of Medicare and Medicare Advantage patients.

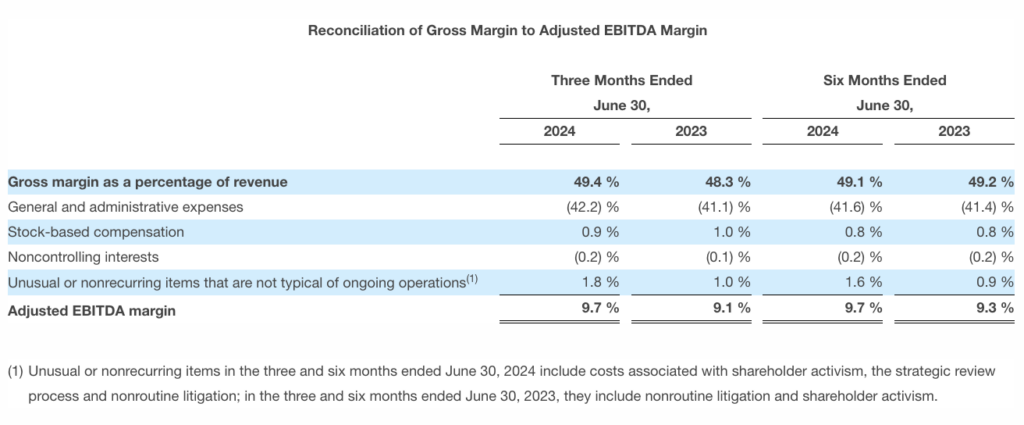

AREX argues that Enhabit’s overhead is too high and is questioning why Enhabit has not announced a significant cost reduction initiative.

- Enhabit has been independent from its original parent company for only two years and during this time has needed to make expenditures to stand itself up as an independent public company. At the time of the spin-off, Enhabit did not have built-out finance, HR and IT infrastructures, and developing these infrastructures required significant investment. As of today, Enhabit’s investment in its HR structure has successfully eliminated high-cost contract labor in both its Home Health and Hospice segments. Enhabit has also focused on the buildout of the IT organization to enhance its analytics capabilities and automate processes. Additionally, administering Medicare Advantage admissions and payment requires more time and personnel than is required to manage Medicare fee-for-service. Enhabit continues to seek out and evaluate opportunities to reduce overhead costs while maintaining the appropriate infrastructure to support operations.

- AREX’s criticism is based on a crude comparison of Enhabit’s financial statements against two other public companies. When comparing Enhabit to other companies, AREX does not account for the differences in the size, business models and cost allocation methodologies. AREX’s assertion that another $10 million of cost cuts could be implemented with no impact on the operations or revenue shows a deep misunderstanding of our operations and business and provides a case as to why stockholders should fear AREX having an outsized voice on the Board.

AREX’S PROPOSED “TRANSFORMATION COMMITTEE” WOULD COMPRISE NOMINEES WHO ARE ILL-SUITED FOR THAT ROLE

AREX portrays their candidates as having “home health and hospice” experience. However, upon closer look beyond AREX’s high-level messaging, the AREX nominees have largely outdated experience and negligible leadership experience, and they lack achievements in home health and hospice. AREX consistently makes bold statements about their candidates’ strong histories and individual track records that are incompatible with the roles held by the candidates.

We urge stockholders to review the actual professional biographies of the four AREX director candidates that AREX would have on its proposed “Transformation Committee”: Megan Ambers, Maxine Hochhauser, Anna-Gene O’Neal and Dr. Gregory Sheff:

- All lack material senior operating experience.

- All lack public company board experience.

- All lack public company C-suite experience, except for interim roles that did not lead to permanent positions.

- All have career experience commensurate with positions that would report to members of Enhabit’s C-suite. These track records are not reflective of a director at a public company.

- None has significant tenure in a relevant role that experienced current industry trends.

- None appears to have served for a material time in executive positions where they had regular interaction with a public company board of directors.

The following is a closer look at the professional biographies of these candidates and AREX’s overstatements about them. These are not “ad hominem” criticisms, but observations about the professional experience of AREX’s nominees relative to AREX’s statements about them.

Megan Ambers

AREX claims that Megan Ambers, 42, “brings a deep understanding of home health and hospice labor strategies, operations, payor models, utilization, and organizational optimization from her tenure at Enhabit’s closest public peer, Amedisys.” AREX touts that Ms. Ambers “possesses an acute understanding of how to accelerate home health and hospice admission growth, particularly fee-for-service admissions in home health, through incentive plan design, regulatory compliance, onboarding, and career development.”2

We believe AREX has significantly overstated the seniority and depth of Ms. Ambers’ relevant experience.

- Ms. Ambers has no apparent home health and hospice operating experience. Instead, her experience has been limited to interim and non-C-suite roles in human resources. She held the Interim Chief Human Resources Officer (CHRO) role at Amedisys for eight months in 2022 and then she did not continue in the role.

- Prior to that brief role, from 2018 to 2022, Ms. Ambers was an SVP in human resources, and her current role is outside of home health and hospice.

It is unclear how Ms. Ambers obtained her purported expertise in home health and hospice “operations and payor models”. Ms. Ambers’ experience is commensurate with that of a vice president reporting to Enhabit’s current CHRO, who has approximately 30 years of healthcare and human capital experience. AREX touts that Ms. Ambers has experience developing incentive plans in the home health and hospice area, which at most would make her a candidate for a consultancy role. In contrast to Ms. Ambers’ eight months in an interim role which she did not retain, Enhabit’s current CHRO had five years of experience as CHRO at Mercy Health, which has a workforce of approximately 42,000 employees, before taking her current role at Enhabit.

The most comparable candidate on Enhabit’s slate is Susan A. La Monica, an established CHRO with over 25 years of experience in senior executive leadership positions in human capital management. As the CHRO of Citizens Financial, Ms. La Monica has helped to transform Citizens into one of the nation’s largest commercial banks since its IPO in 2014. Her understanding of the complexities of managing a workforce in a widely dispersed branch banking system is directly relevant to the challenges presented in managing Enhabit’s workforce. Ms. La Monica also supports Enhabit’s current CHRO in designing compensation and incentive plans that align with the Company’s strategic priorities, and in overseeing executive compensation matters. Her executive leadership and experience with the transformation of Citizens facilitates her contribution well beyond Ms. Ambers narrow experience base. The Enhabit Board believes it would be value-destructive to replace Ms. La Monica with Ms. Ambers.

Maxine Hochhauser

AREX claims that Maxine Hochhauser, 63, “brings more than 30 years of experience as a healthcare industry executive focused on home health and home care operations, and a history of successfully navigating challenging financial, regulatory, and payor transitions.” AREX touts that Ms. Hochhauser is “Former President of the Home and Community Based Services Division of LHC Group, Inc., a provider of in-home healthcare services.”

We have had professional interactions with Ms. Hochhauser and believe that AREX has overstated her experience and fitness for the Enhabit Board.

- Ms. Hochhauser headed up the Home and Community Based Services Division of LHC Group, Inc., a division distinct from their home health and hospice divisions. While AREX implies that Ms. Hochhauser’s experience running the community care division is directly relevant to home health and hospice, community care is a completely different industry. In community care, a company’s workforce provides assistance with grooming and feeding, medication reminders, meal preparation, housekeeping, respite care, transportation and errand services. Home health and hospice operates in a different environment from the regulatory, reimbursement and referral process perspectives than community care. As a result, Ms. Hochhauser’s experience at LHC Group, Inc. has minimal relevance to the home health and hospice business, despite AREX’s attempt to portray it differently.

- Ms. Hochhauser’s most recent experience at Addus was over seven years ago for a period of approximately two years. Her tenure includes working in Addus’ home health and hospice division, which is a small part of its overall business, and completely predates the payor mix shift and current labor dynamics that have been central focuses of Enhabit’s business.

Against this backdrop, AREX cannot credibly claim that Ms. Hochhauser has sufficient experience in “payor transitions” to understand the dynamics of the current payor environment, especially relative to Enhabit’s nominees who have worked directly for multiple third-party payors.

Finally, as the current CEO of HealthPRO Heritage (since 2023), Ms. Hochhauser leads a company that competes with Enhabit in a discrete part of HealthPRO Heritage’s business. HealthPRO Heritage partners with home health agencies by providing agency and rehab services with operational management, reimbursement expertise, market analytics and professional staffing. Information, insights and experience that Ms. Hochhauser would be exposed to if she were serving on the Board of Enhabit’s substantially larger operation could be used to HealthPRO Heritage’s advantage in competing against Enhabit, for example, in the market for engaging skilled clinicians in areas where Enhabit operates.

Anna-Gene O’Neal

AREX claims that Anna-Gene O’Neal, 57, “brings 35 years of healthcare experience, including leadership positions in home health and hospice operations, and a strong track record of driving business growth, turning around operations, and improving the quality of patient care.” AREX touts that she is “Former Division President, Health Care Services of Brookdale Senior Living, Inc, where she ran the home health, hospice, and outpatient therapy division.”

Ms. O’Neal has substantially less experience, by decades, in overseeing home health and hospice as compared to Enhabit’s current executive officers.

- The bulk of her home health and hospice experience was from 2012 to 2019 at a small hospice care company.

- Over the past approximately five years, Ms. O’Neal’s experience in home health and hospice was spread over four different companies and with short tenures ranging from approximately six months to two years. It is not clear how she can have a “strong track record of driving business growth, turning around operations and improving the quality of patient care” with such short tenures in all of her recent positions, and it is not clear how such short tenures can meaningfully contribute to her knowledge base in the home health and hospice industry.

- While AREX touts Ms. O’Neal’s experience at Brookdale’s Senior Living, Inc division, Brookdale’s home health and hospice business is a small part of its overall business that did not face the same referral management hurdles during the Medicare Advantage mix shift.

Ms. O’Neal’s level of experience is commensurate with that of a Senior Vice President reporting to one of Enhabit’s Executive Vice Presidents of operations, who each have three decades or more of experience.

Dr. Gregory Sheff

AREX claims that Dr. Sheff, 55, “brings a comprehensive understanding of home health and hospice operations and insight into large payors along with more than 20 years of healthcare experience, both as a practicing physician and executive.” AREX touts that Sheff is “Former Interim President, Home Solutions, and Chief Medical Officer, Home Solutions, where he led the strategy, operations, partnerships, and integration of multiple home-based care assets at Humana, Inc.”

Dr. Sheff is known to members of Enhabit’s senior management and the Board believes AREX’s claims about Dr. Sheff’s insights into payors and his management capabilities are overstated.

- Dr. Sheff’s roles at Humana, Inc. were in a small subsidiary in the home health and hospice business where he primarily served as Chief Medical Officer, a position that generally involves overseeing clinical operations and quality of care, not driving strategy, partnerships and integration.

- Dr. Sheff has no apparent home health and hospice operating experience beyond having served as the Interim President, Home Solutions at Humana, Inc. for approximately eight months – in a role he did not continue.

- As a result, it is difficult to understand how Dr. Sheff had such broad responsibilities as leading “strategy, operations, partners and integration of multiple home-based care assets.” Additionally, he does not appear to have payor experience relevant to Enhabit, such as negotiating contracts, pricing or value-based initiatives, from working at Humana, Inc.

By contrast, our director nominees, Tina L. Brown-Stevenson and Erin P. Hoeflinger each possess several decades of knowledge and experience in the payor industry. If he were to pursue an operating role at Enhabit, Dr. Sheff’s experience would be commensurate with that of a non-executive officer reporting to Enhabit’s current Executive Vice President of Strategy and Clinical Excellence.

Finally, Dr. Sheff is currently providing services to a portfolio company of Vistria Group, a private equity firm which funded the formation of an Enhabit competitor (VitalCaring) by our founder and former CEO. Vistria is a defendant in litigation brought by Enhabit and Encompass in the Delaware Court of Chancery. The Board is concerned about the potential conflict posed by Dr. Sheff having a role on the Board while the Company is actively suing Vistria for substantial damages and Vistria is heavily invested in the success of a competing entity.

GIVING AREX CONTROL OF THE ENHABIT BOARD NOW IS VALUE-DESTRUCTIVE AND RECKLESS

Enhabit has just passed its two-year anniversary as a public company following its separation from Encompass. During that period, in the face of substantial industry and company-specific headwinds, our Board and management team stabilized Enhabit’s business and built the necessary infrastructure to enable stockholder value creation as a separate public company. Shifting course now and handing control of the Board to AREX and its less experienced nominees so they can learn our business on the job would be value-destructive and reckless.

AREX has announced an operating plan for Enhabit3 that is superficial and reflects AREX’s and its nominees’ lack of understanding of the issues and the key drivers of Enhabit’s business. For over a year, AREX only ever advocated for a sale of Enhabit. Now, AREX speaks only in general terms and its “plan” proposes three months of evaluation, so its nominees can get up to speed, which itself may be destabilizing and stop momentum.

YOUR VOTE MATTERS – PROTECT THE VALUE OF YOUR INVESTMENT BY VOTING THE YELLOW PROXY CARD TODAY

The Enhabit Board of Directors is committed to acting in the best interests of stockholders. We urge you vote the YELLOW proxy card today “FOR” ONLY Enhabit’s nine highly qualified nominees – Jeffrey W. Bolton, Tina L. Brown-Stevenson, Charles M. Elson, Erin P. Hoeflinger, Barbara A. Jacobsmeyer, Susan A. La Monica, Stuart M. McGuigan, Gregory S. Rush and Barry P. Schochet.

Thank you for your continued support of and investment in Enhabit.

Sincerely,

The Enhabit Board of Directors

If stockholders have questions or need assistance voting their shares, please contact:

MacKenzie Partners, Inc.

Toll-Free: 1-800-322-2885

Or

Email: [email protected]

About Enhabit Home Health & Hospice

Enhabit Home Health & Hospice (Enhabit, Inc.) is a leading national home health and hospice provider working to expand what’s possible for patient care in the home. Enhabit’s team of clinicians supports patients and their families where they are most comfortable, with a nationwide footprint spanning 255 home health locations and 112 hospice locations across 34 states. Enhabit leverages advanced technology and compassionate teams to deliver extraordinary patient care. For more information, visit ehab.com.

Forward-Looking Statements

Statements contained in this press release which are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All forward-looking information speaks only as of the date hereof, and Enhabit undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from our present expectations include, but are not limited to, our ability to execute on our strategic plans, regulatory and other developments impacting the markets for our services, changes in reimbursement rates, general economic conditions, changes in the episodic versus non-episodic mix of our payors, the case mix of our patients, and payment methodologies, our ability to attract and retain key management personnel and health care professionals, potential disruptions or breaches of our or our vendors’, payors’, and other contract counterparties’ information systems, the outcome of litigation, our ability to successfully complete and integrate de novo locations, acquisitions, investments, and joint ventures, our ability to successfully integrate technology in our operations, our ability to control costs, particularly labor and employee benefit costs, and impacts resulting from the announcement of the conclusion of the strategic review process. Additional information regarding risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this press release are described in reports filed with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, copies of which are available on the Company’s website at http://investors.ehab.com and free of charge through the website maintained by the SEC at www.sec.gov. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this press release.

Important Additional Information and Where to Find It

The Company has filed a definitive proxy statement on Schedule 14A and other documents with the SEC in connection with its solicitation of proxies from the Company’s stockholders for the Company’s 2024 annual meeting of stockholders. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING YELLOW PROXY CARD, AND ALL OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the definitive proxy statement, an accompanying YELLOW proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge by clicking the “SEC Filings” link in the “Investors” section of the Company’s website, http://investors.ehab.com, or by contacting [email protected] as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

1 Enhabit’s “peer” group as identified by AREX: Amedisys, Inc. and The Pennant Group, Inc.

2 These and other references to AREX candidates are to the AREX Investor Presentation dated June 27, 2024.

3 AREX Investor Presentation, June 27, 2024.

Media contact

Erin Volbeda

[email protected]

972-338-5141

Investor relations contact

Crissy Carlisle

[email protected]

469-860-6061