If you are in the stage of life where it’s time to choose a federal health insurance plan, you might know it can feel overwhelming. Although Medicare is the default federal health insurance program in the United States, there are different coverage options you can choose from – one of those being a Medicare Advantage Plan.

As of 2022, 48% of Medicare beneficiaries were enrolled in a Medicare Advantage plan, according to KFF. But just because almost a majority of Americans have chosen Medicare Advantage doesn’t mean it’s automatically the right plan for you.

It is important to know the difference between Medicare and Medicare Advantage so you can determine how each may affect your health care journey.

What is Original Medicare?

American adults that are at least 65 years old are eligible for federal health insurance coverage through Medicare. Original Medicare is the name given to the original health insurance plan that was signed into effect by former President Lyndon B. Johnson in 1965.

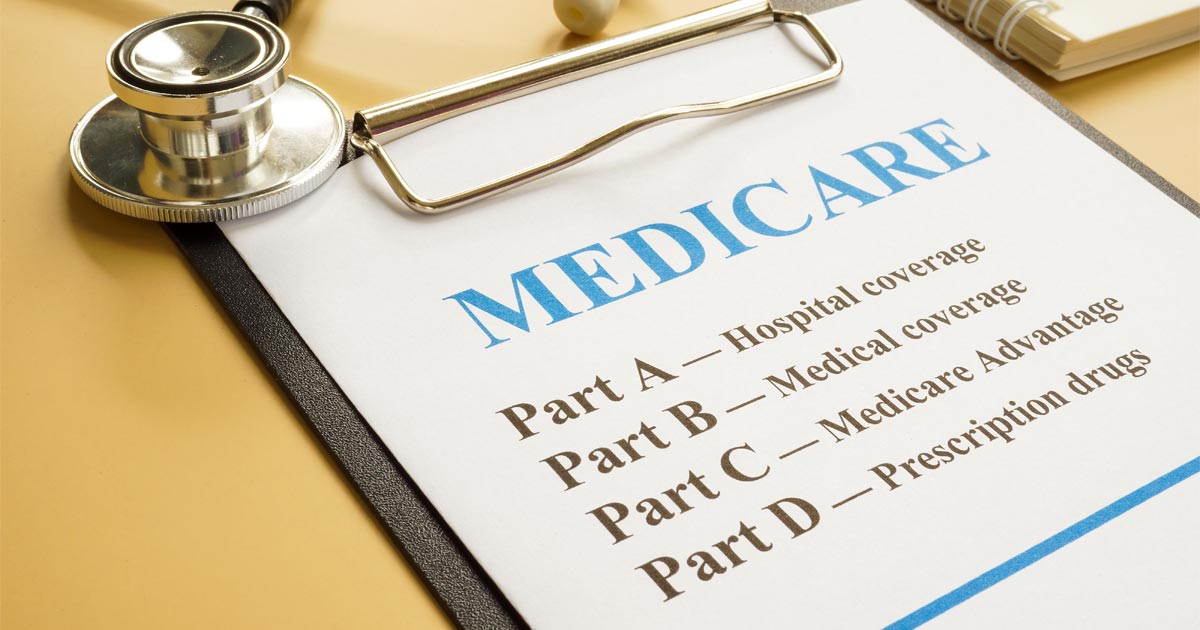

Original Medicare is made up of two parts:

- Part A: the hospital insurance component

- This offers coverage for inpatient care, or care where you must stay overnight to receive treatment in a medical facility. This includes hospitals, skilled nursing or home health or hospice care.

- Part B: the medical insurance component

- This helps cover services such as preventative or routine visits from physicians or health care providers. It can also help cover outpatient care or home health care, and the cost of medical equipment such as wheelchairs, walkers or hospital beds needed during your care.

When you sign up for Medicare, there are two options for coverage. The first option is Original Medicare with the ability to add Part D (drug coverage) onto your plan.

The second option for coverage is Medicare Advantage (sometimes called Part C or an MA plan). Although there are similarities in names, there are notable differences between Medicare and Medicare Advantage.

What is Medicare Advantage?

Although Medicare Advantage is Medicare-approved, it is not offered directly from the federal government like Original Medicare. Instead, specific, private, Medicare-approved insurance companies offer MA plans.

Overall, Medicare Advantage is seen as an alternative to Original Medicare and is often referred to as a “bundled plan.” This means that hospital insurance (Part A), medical insurance (Part B) and drug coverage (Part D) are all included in the one Medicare Advantage Plan.

MA plans include all the same Part A and Part B benefits that Original Medicare does, including emergency and urgent care services.

Please note, Medicare Advantage won’t cover costs for clinical trials or potential benefits delivered by new legislation. Additionally, MA plans can choose not to cover the costs of services that aren’t medically necessary under Medicare. You should always check with your provider about estimated costs and coverage before receiving a service.

The difference between Medicare and Medicare Advantage

So, if MA plans offer the same Part A and Part B coverage as Original Medicare, what’s the difference between Medicare and Medicare Advantage?

In addition to the hospital, medical and drug coverage offered, Medicare Advantage plans may choose to offer benefits such as covering transportation costs to physician appointments, free gym memberships and vision and dental coverage.

But there are some added barriers to receiving these benefits. With a MA plan, you may face:

- A small network of doctors

- The need for referrals and prior authorizations

- High out-of-pocket costs

- Non-traveling coverage

- Annual benefit changes

Is Medicare or Medicare Advantage right for me?

Health care decisions, such as what medical insurance to choose, are personal and should be made based on the coverage you specifically need.

Here are a few important takeaways to consider when making your decision:

| Medicare Advantage offers additional vision, eye and dental benefits that Original Medicare does not. | Although MA Plans may have low premiums, you will still be responsible for your Original Medicare costs. |

| Unlike Original Medicare, MA plans do have yearly cost limits on your out-of-pocket costs. Once you reach your limit, all covered services will be free. | The network for Original Medicare is much larger than for Medicare Advantage. |

| Medicare Advantage may be able to save you money in times of good health, but higher out-of-pocket costs can add up quickly. And if you become sick, it could be more difficult to switch plans. | Unlike the fixed costs with Original Medicare, MA plans allow each insurance company to establish their own rules about out-of-pocket costs, emergency coverage and more. These rules can change each year. |

To see a full breakdown of the differences between Original Medicare and Medicare Advantage, visit Medicare.gov.

Does Medicare Advantage cover hospice or home health services?

Considering Medicare Advantage covers the same items as Original Medicare, MA plans will cover care related to hospice or home health services. However, MA plans typically take a more active role in authorizing or denying services.

If you are on a Medicare Advantage plan, your home-based care agency will have to coordinate care with your MA plan through an authorization process. This means coverage may differ from Original Medicare.

Additionally, it is important to note that if you were in a MA plan before starting hospice care, your plan may offer coverage for health problems unrelated to your terminal illness.

However, these services will not be fully covered. What you pay will depend on if you continue to pay your premiums, follow your plan’s coverage rules and use in-network providers.

Medicare makes it easy to find certified home health and hospice care. You can visit Medicare.gov to search for a provider near you.

Enhabit Home Health & Hospice is the fourth-largest Medicare-certified home health and hospice provider in the nation. Visit our website to find a location near you and talk to your physician about a referral to our services.

Social Share

At Enhabit our patients are our number one priority. From providing the latest medical practices to building deep personal connections, we’re focused on upholding every patient’s dignity, humanity and sense of control on their health care journey.

Home health

Our home health services give patients access to the care they deserve in the comfort of their own homes. From disease and injury management to recovery from surgery, our clinicians help patients confidently achieve their healthcare goals.

Hospice care

Our hospice care services place importance on the comfort of every patient living with a terminal illness. Our caring professionals are dedicated to providing not just physical care, but spiritual and emotional support to every patient and their loved ones.

Back to Resource library

Back to Resource library