Enhabit Reports Third Quarter Financial Results

DALLAS–(BUSINESS WIRE)– Enhabit, Inc. (NYSE: EHAB), a leading home health and hospice care provider, today reported its results of operations for the third quarter ended September 30, 2022.

“We are making progress on our strategic initiatives,” Enhabit’s President and Chief Executive Officer, Barb Jacobsmeyer said. “During the quarter, labor constraints began to ease as our efforts around investment in our people began to take hold. We saw strong growth in Medicare Advantage admissions as we continued to expand in this growing part of our markets. The strategic and operational changes we are implementing in our hospice operations are having a positive impact as evidenced by our sequential growth in admissions and average daily census. We remain focused on the long-term growth of Enhabit.”

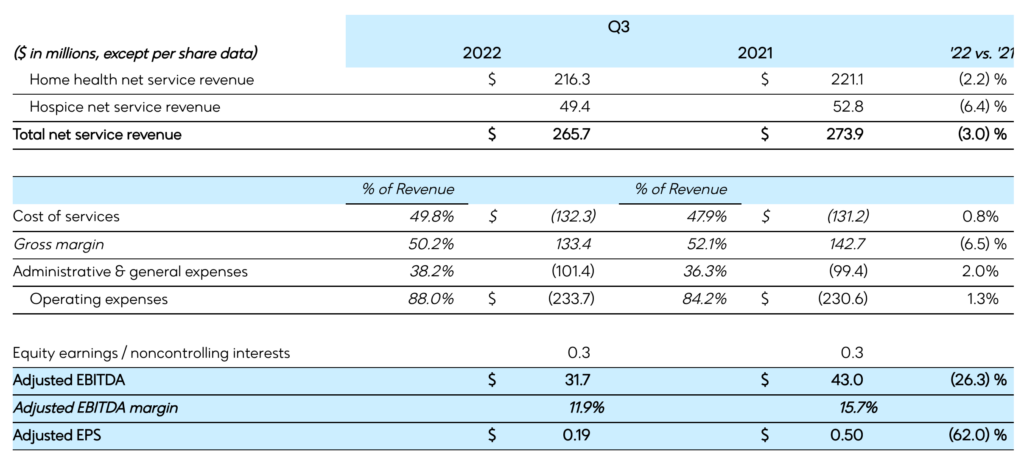

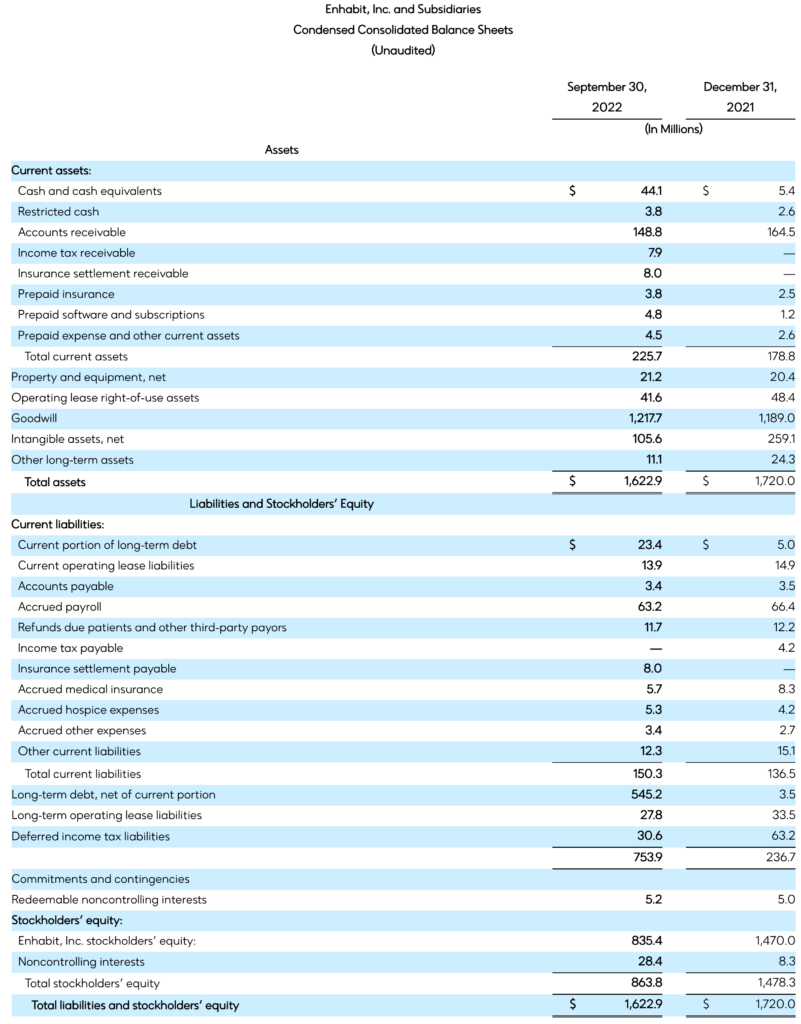

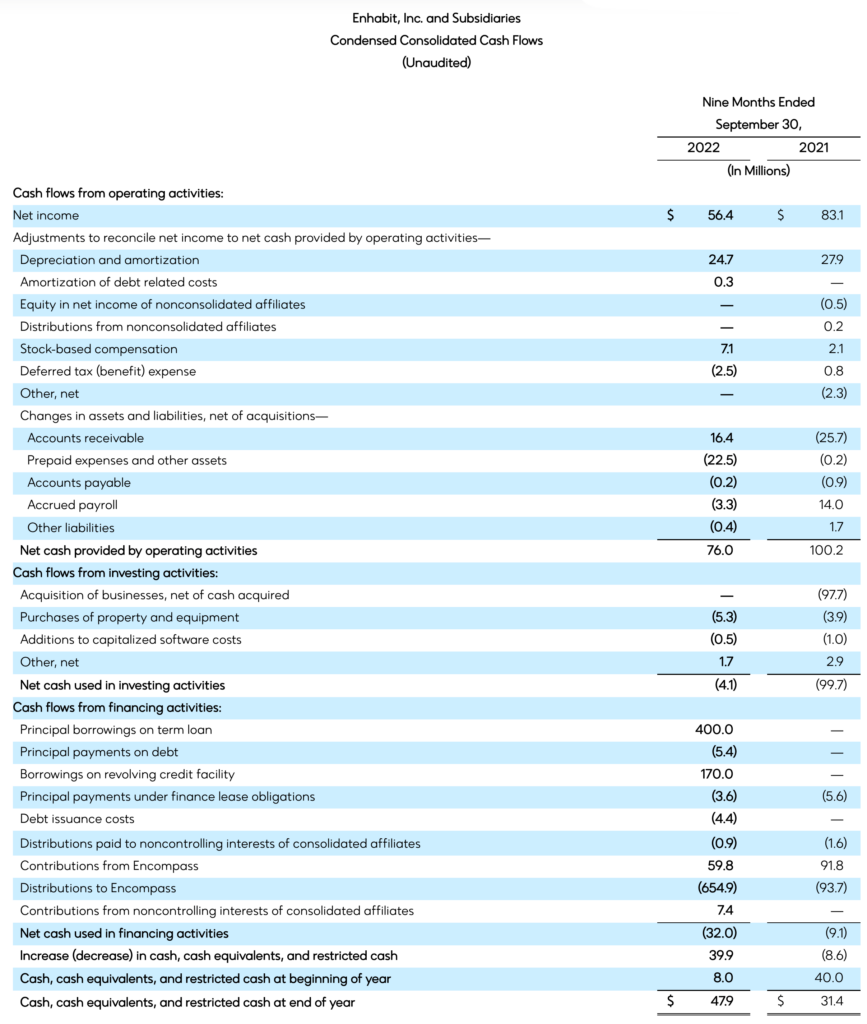

QUARTERLY PERFORMANCE – CONSOLIDATED

Consolidated third quarter 2022 results were impacted by the resumption of sequestration, continued shift to more non-episodic patients in home health, lower volumes in hospice, and higher cost of services related to labor, mileage reimbursement and fleet costs.

- Net service revenue of $265.7 million, declined 3.0% from Q3’21

- Net income of $8.6 million, declined 60.2% from Q3’21

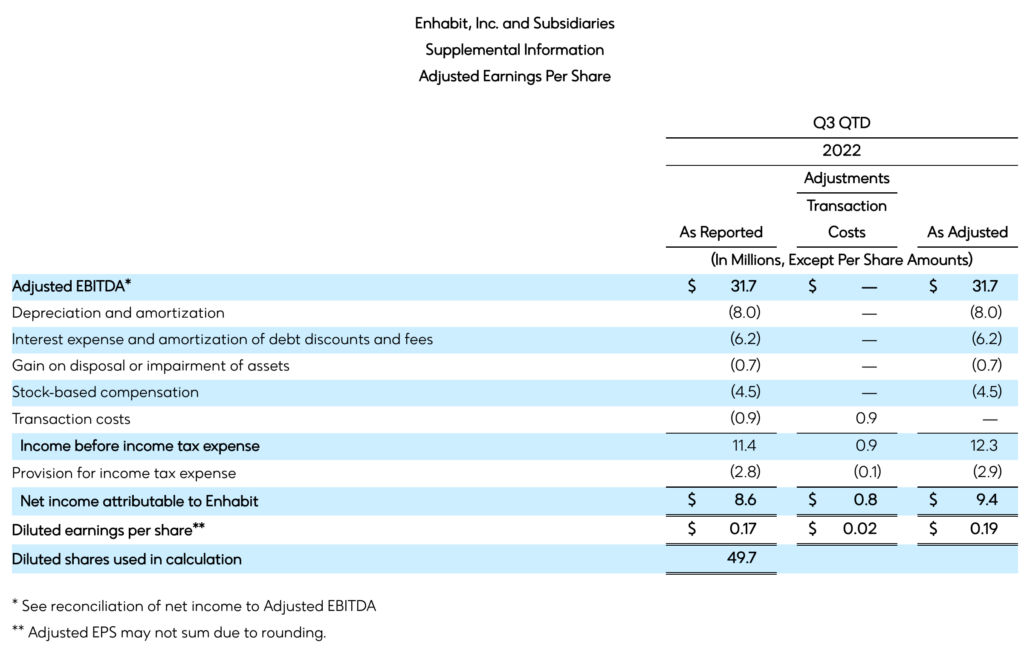

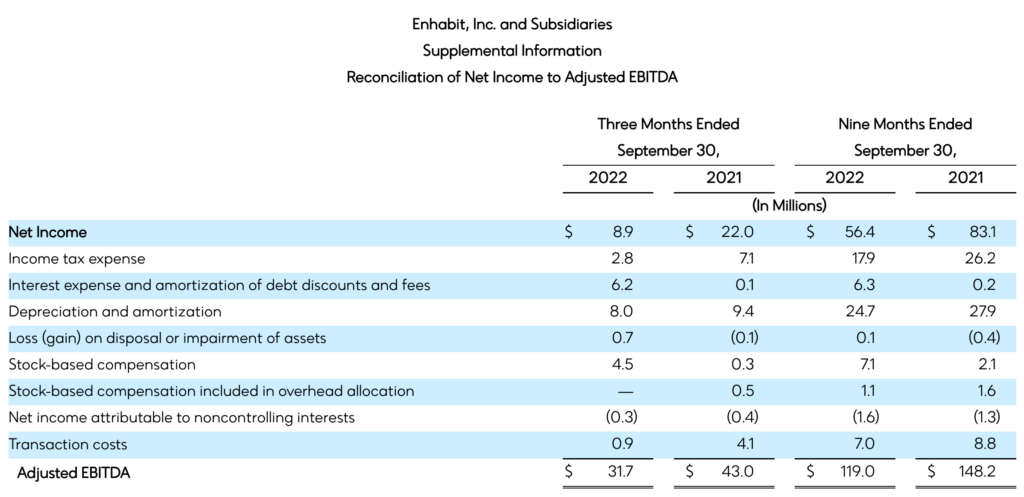

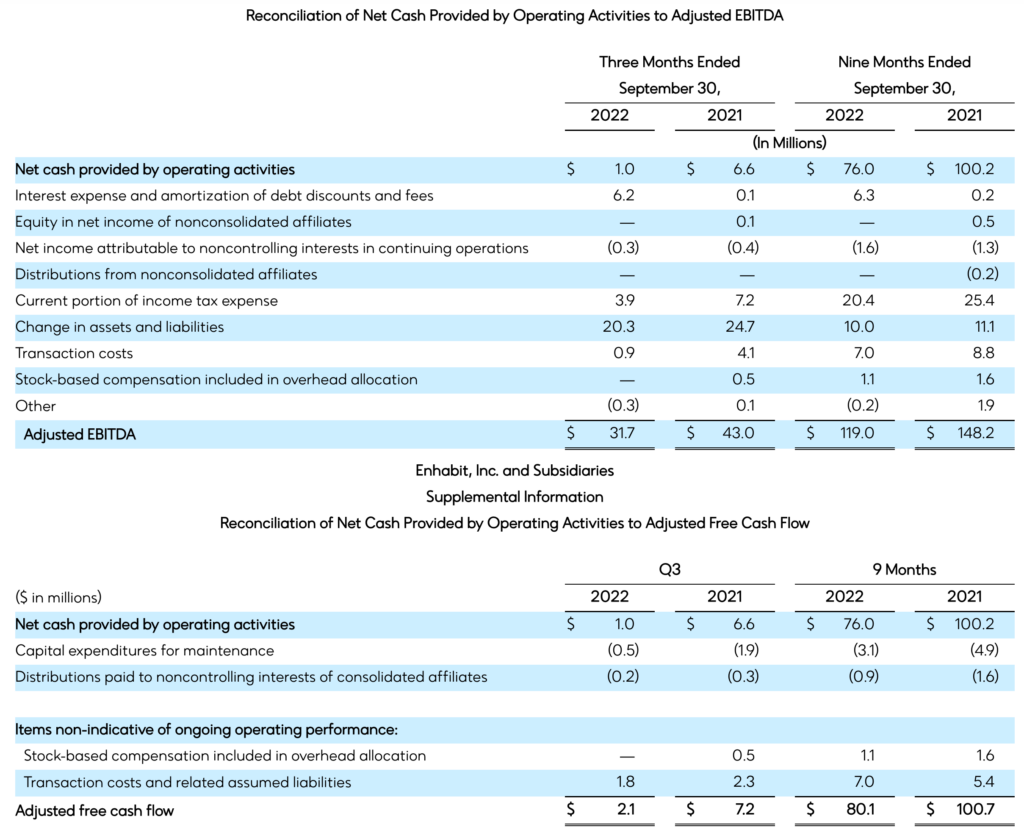

- Adjusted EBITDA of $31.7 million, down 26.3% from Q3’21

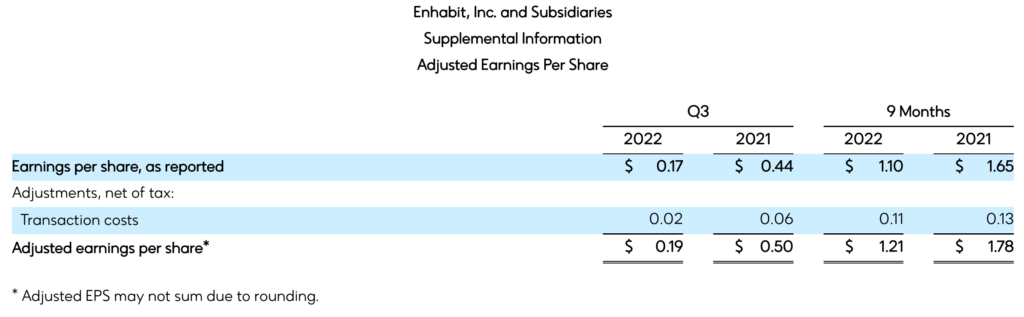

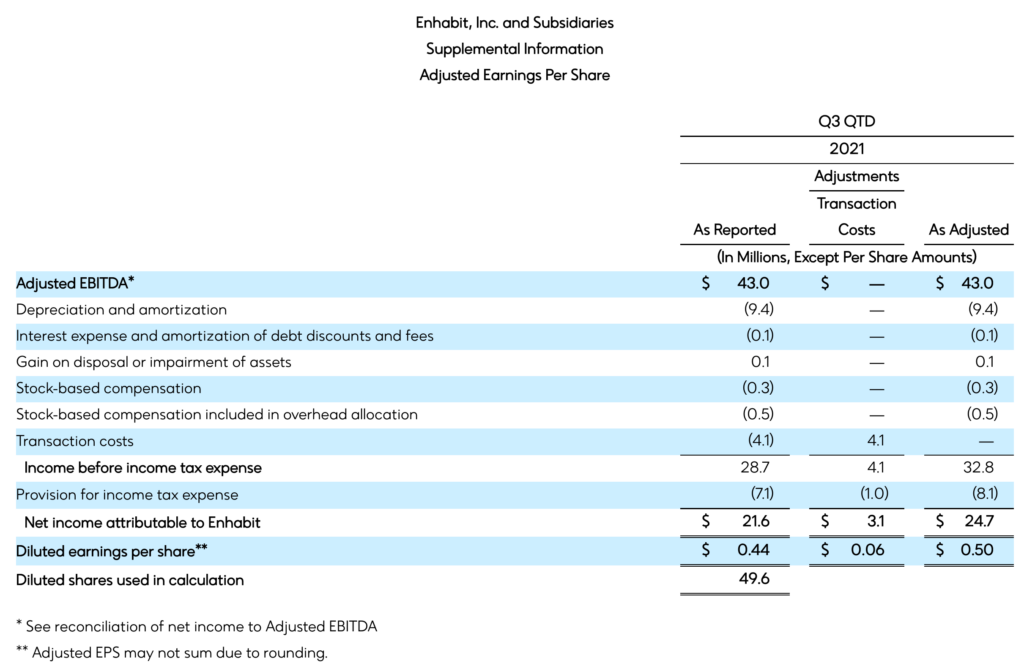

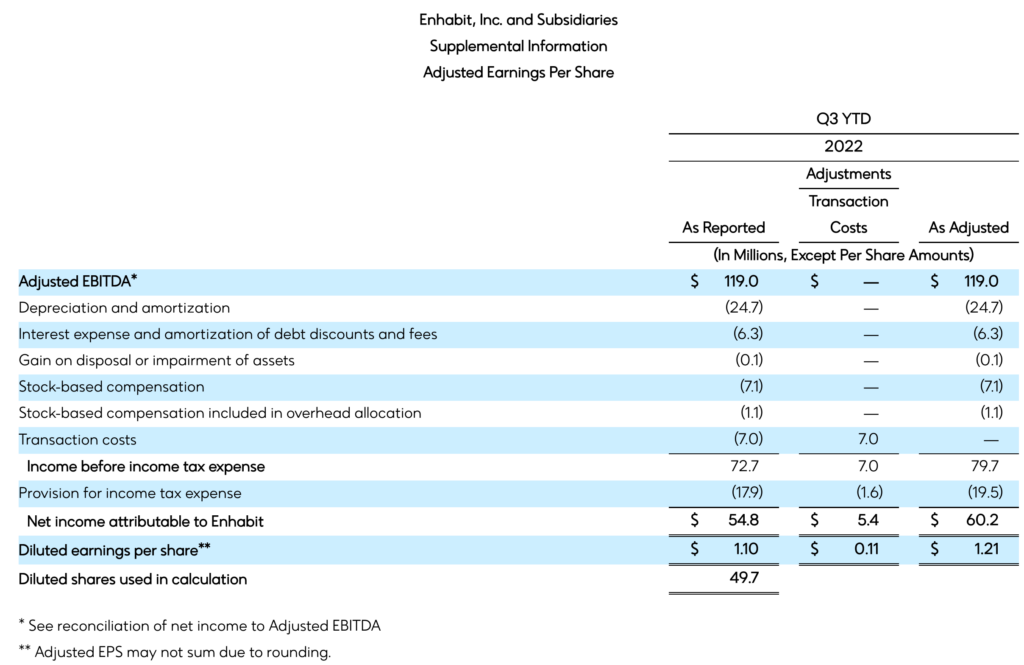

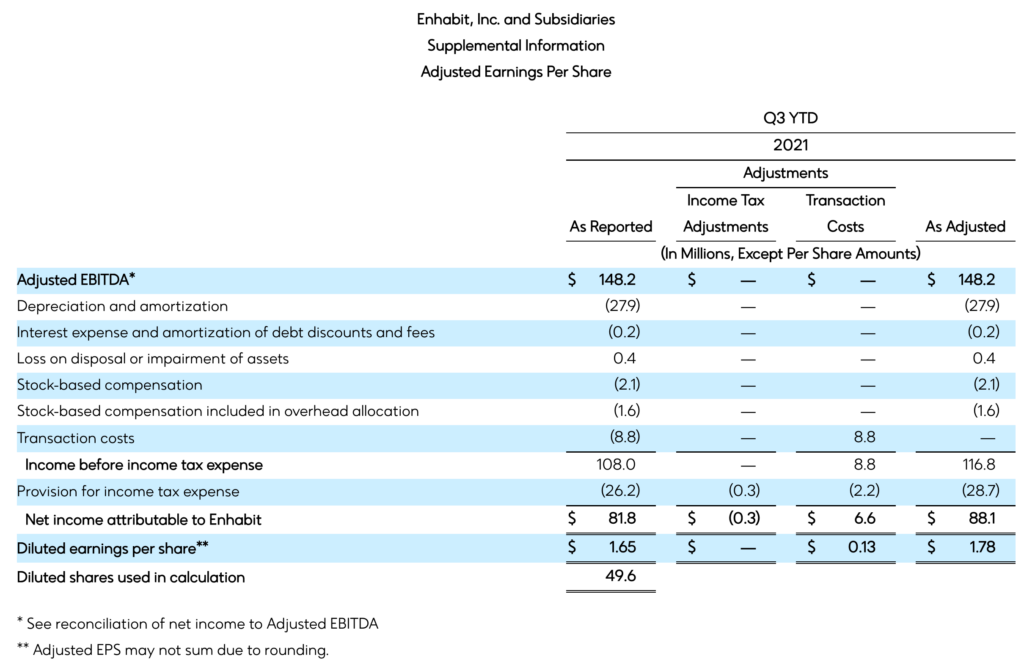

- Earnings per diluted share of $0.17

- Adjusted earnings per diluted share of $0.19

RECENT COMPANY HIGHLIGHTS

- Home health continues to show strong growth in Medicare Advantage admissions, with non-episodic admissions up 31.5% year over year.

- Strategic changes are providing positive momentum in hospice with sequential admissions and average daily census growth during the third quarter.

- Agreed to terms with nine Medicare Advantage and commercial regional or multistate plans.

- Completed the acquisitions of Caring Hearts Hospice and Unity Hospice on October 1, 2022 and November 1, 2022, respectively, adding four locations in Texas and one in Arizona.

FINANCIAL RESULTS

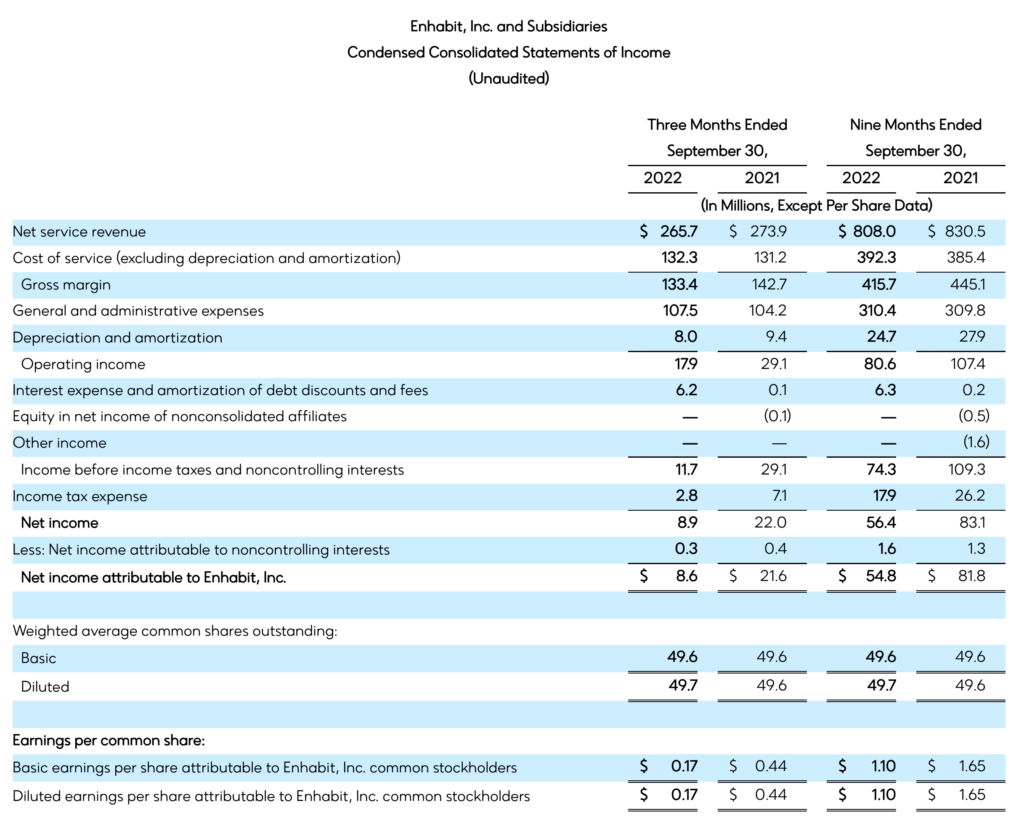

Consolidated

The resumption of sequestration, continued shift to more non-episodic patients in home health, and lower volumes in hospice combined to decrease consolidated revenue by $15 million year over year.

Adjusted EBITDA decreased year over year primarily due to the resumption of sequestration; continued shift to more non-episodic patients in home health; lower volumes in hospice; higher costs of services related to labor; incremental costs associated with being a stand-alone company; and fleet and mileage reimbursement.

SEGMENT RESULTS

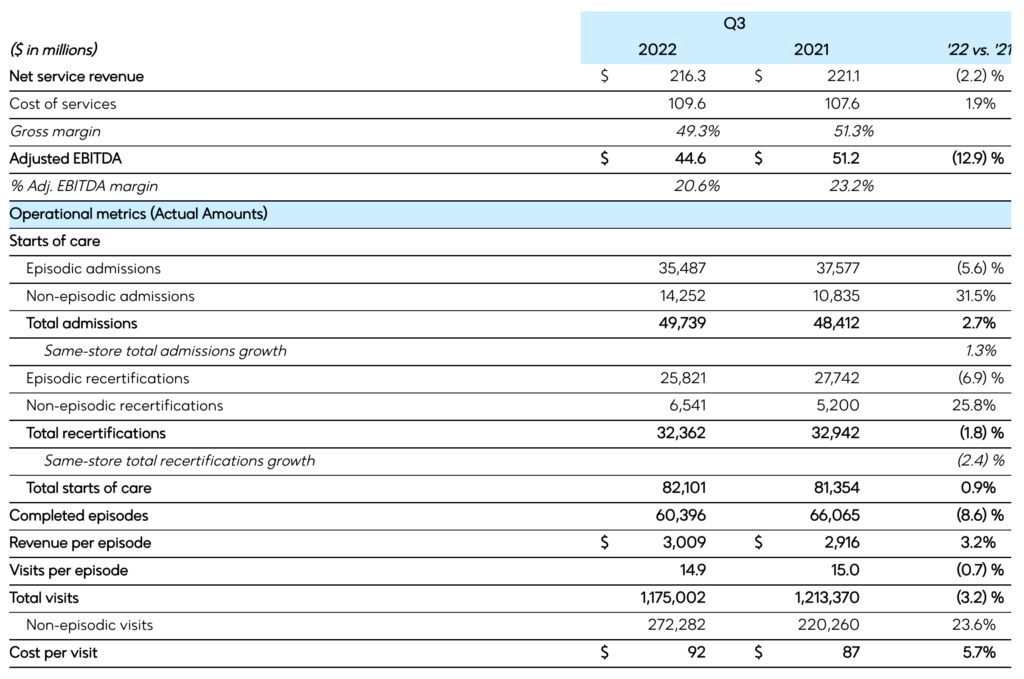

Home health

The year-over-year decrease in revenue was due primarily to the resumption of sequestration and continued payor mix shift to more non-episodic patients. Revenue per episode increased year over year primarily due to an increase in Medicare reimbursement rates, the timing of completed episodes, and patient mix under the Patient Driven Groupings Model offset by the resumption of sequestration.

Adjusted EBITDA decreased year over year primarily due to lower revenue and higher cost of services related to labor, fleet, mileage reimbursement, and workers’ compensation costs.

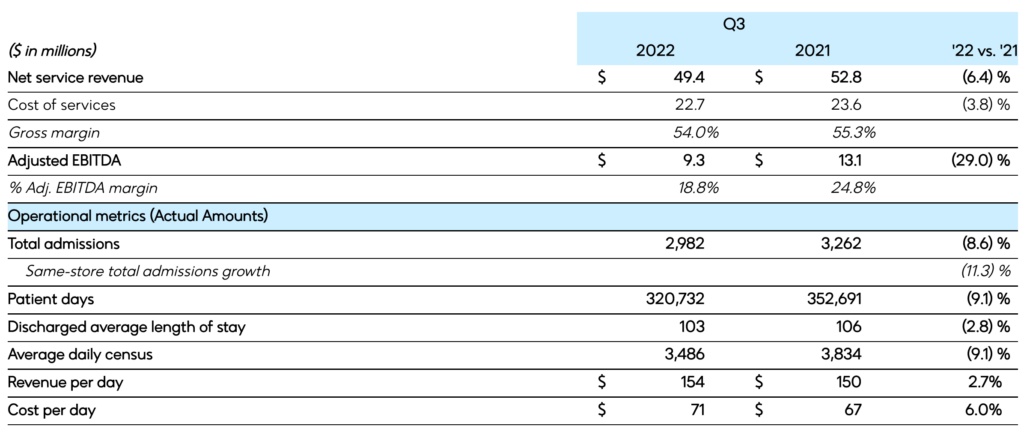

Hospice

The year-over-year decrease in revenue primarily was due to the decrease in average daily census and resumption of sequestration. Admissions increased sequentially from the second quarter of 2022 primarily due to improvements in staffing capacity and an increase in referral sources.

Adjusted EBITDA decreased year over year primarily due to lower revenue and higher cost of services related to labor (including increased use of contract labor), fleet, and mileage reimbursement.

The Company updated its full-year 2022 guidance as follows:

| Full-year 2022 | Revised Guidance | Prior Guidance |

| Net Service Revenue | between $1,070 and $1,080 million | between $1,075 and $1,110 million |

| Adjusted EBITDA | between $150 and $155 million | between $155 and $170 million |

| Adjusted EPS | between $1.37 and $1.50 | between $1.47 and $1.75 |

For additional considerations regarding the Company’s 2022 guidance ranges, see the supplemental information posted on the Company’s website at http://investors.ehab.com. See also “Other Information” below for an explanation of why the Company does not provide guidance for comparable GAAP measures for Adjusted EBITDA and Adjusted EPS.

The Company will host an investor conference call at 10 AM Eastern Time on Nov. 2, 2022 to discuss its results for the third quarter of 2022. To access the live call by phone, dial toll-free (888) 660-6150 or international (929) 203-0843; the conference ID is 5248158. A simultaneous webcast of the call, along with supplemental information, may be accessed by visiting http://investors.ehab.com. Following the call, a replay will be available at the same location.

ABOUT ENHABIT HOME HEALTH & HOSPICE

Enhabit Home Health & Hospice is a leading national home health and hospice provider working to expand what’s possible for patient care in the home. Enhabit’s team of clinicians supports patients and their families where they are most comfortable, with a nationwide footprint spanning 250 home health locations and 100 hospice locations across 34 states. Enhabit leverages advanced technology and compassionate teams to deliver extraordinary patient care. For more information, visit ehab.com.

Note regarding presentation of non-GAAP financial measures

The financial data contained in the press release and supplemental information includes non-GAAP financial measures as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted EPS, and adjusted free cash flow. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP are presented on the attached schedules.

However, the Company is unable to reconcile, without unreasonable effort, its guidance of Adjusted EBITDA and adjusted EPS to their corresponding GAAP measures due to the inherent difficulty in predicting, with reasonable certainty, the future impact of items that are outside the control of the Company or otherwise non-indicative of its ongoing operating performance. Such items include, but are not limited to, gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); and items related to corporate and facility restructurings. For the same reasons, the Company is unable to address the probable significance of the unavailable information.

Note regarding presentation of same-store comparisons The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on home health and hospice locations open throughout both the full current period and the immediately prior period presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company’s results of operations.

FORWARD-LOOKING STATEMENTS

Statements contained in this press release which are not historical facts, such as those relating to future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All such estimates, projections, and forward-looking information speak only as of the date hereof, and Enhabit undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by Enhabit include, but are not limited to, our ability to execute on our strategic plans, regulatory and other developments impacting the markets for our services, changes in reimbursement rates, general economic conditions, our ability to attract and retain key management personnel and healthcare professionals, potential disruptions or breaches of our or our vendors’ information systems, the outcome of litigation, our ability to successfully complete and integrate de novo developments, acquisitions, investments, and joint ventures, and our ability to control costs, particularly labor and employee benefit costs. Our Form 10 Registration Statement dated June 14, 2022 and subsequent quarterly reports on Form 10-Q, each of which can be found on the Company’s website at http://investors.ehab.com and the SEC’s website at www.sec.gov, discuss other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this press release. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this press release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221101006290/en/

Investor Relations Contact

Jennifer Hills 469-860-6061 [email protected]

Media Contact

Erin Volbeda 972-338-5141 [email protected]

Source: Enhabit, Inc.